OKX Review

OKX is unavailable in the U.S. and Canada, and comes with its share of problems. However, there are also good points, like its friendly spot trading interface and wealth of resources for beginners. Our OKX review has the whole story.

Whether you’re new to cryptocurrency or looking for a new exchange, you may have heard of OKX (formerly known as OKEx). It’s one of the 15 or so highest-volume cryptocurrency exchanges in the world, with a daily trading volume of around $1 billion. In our OKX review, we’ll explore every angle to help you decide if it’s the right home for your cryptocurrency.

Key Takeaways: OKX Crypto Exchange

- The OKX cryptocurrency exchange is not available in the United States or Canada. Users in those countries can trade through a VPN or choose Okcoin instead.

- OKX charges no fees to deposit or convert currencies. It supports about 350 popular assets and offers gamified lessons to help new traders get started.

- You’ll be charged a fee to withdraw money and you won’t know in advance how much you’ll pay. There’s also no way to hold fiat currencies without making a purchase.

- OKX has had some shady behavior in its past, including accusations of inflating its trading volume and a couple of police investigations involving the CEO.

OKX exchange users can trade 355 different crypto assets and make passive money from staking and crypto savings accounts. Its trading fees are extremely low, maxing out at 0.1% — about one-sixth of Coinbase’s highest bracket (see our Coinbase review). It comes with simplified features for beginners, including a demo mode that new traders can use to practice.

Despite these attractive features, the OKX crypto exchange is not without controversy, with some of its practices raising eyebrows even in the wild-west world of crypto. Most seriously, investors have accused it of misrepresenting its trading volumes. Like KuCoin (see our KuCoin review for details), it’s not licensed to trade in the U.S. and is also unavailable in Canada.

Before you go on, note that trading crypto is incredibly risky, even at the best of times. Crypto is highly volatile and prone to steep crashes that can wipe out your savings. The risk is even greater if you delve into margin trading (which the OKX exchange permits). Before putting any money into a cryptocurrency exchange, make sure you have a safety net and an exit plan.

Before you go on, know that crypto trades are incredibly risky even in the best of times. Crypto values can rise, but they can also plummet, leaving you wiped out. This risk is multiplied many times over should you start speculating in crypto derivatives.

OKX Review: Pros & Cons

Pros:

- Very low trading fees

- No currency conversion fees

- No deposit fees

- Good at guiding beginners

- Well designed spot trading UI

- Successful investor follows

Cons:

- Unavailable in US & Canada

- False trading volume reports

- Shutdown trades once due to founder arrest

- Cannot deposit fiat currency

- Unclear withdrawal fees

- Poor customer support

Overview & Background

OKX was launched in 2017 by Mingxing “Star” Xu. The exchange was originally based in Beijing, but when China began to ban crypto trading in 2021, OKX closed its Chinese offices and moved out. Its current headquarters are located in the Seychelles. Its parent company also owns Okcoin, a smaller exchange based in San Francisco.

OKX is one of several crypto exchanges to court mainstream attention through an expensive marketing campaign, partnering with everyone from the Manchester City football club to the Tribeca film festival. In 2022, it rebranded from OKEx to OKX, saying that its wide family of decentralized finance (DeFi) products made it more than just a crypto exchange.

Although OKX carefully cultivates its image, it’s been mired in several controversies. In 2020, founder Xu was briefly arrested in connection with a fraud investigation. For approximately a month, while he was held, no users could withdraw funds from OKX. The incident damaged user confidence and dropped the price of OKX’s own coin, OKB, by about 11%.

False Volume Allegations

Perhaps worse than the 2020 arrest incident is a 2018 investigation by crypto trader Sylvain Ribes, which argued that OKX (then OKEx) had faked 93.6% of its total trading volume. Ribes measured several trading pairs for “slippage,” the factor by which selling a certain cryptocurrency reduces its price.

He unexpectedly discovered that pairs on OKX demonstrated vastly more slippage than the same pairs on other exchanges, even though a greater trading volume should have insulated it from massive swings. From this, and from the suspiciously regular price fluctuations on some assets, Ribes concluded that OKX was pumping up its own volume to attract investors.

In 2019, his allegations were bolstered by a detailed report that accused the crypto world of being rife with “wash trading” — exchanges opening puppet accounts to trade assets back and forth and artificially boost the exchange’s volume. An OKX executive openly admitted to wash trading on the exchange, but blamed it on users trying to game the fee structure.

At the time of the report, OKX had been the largest international cryptocurrency exchange by market cap. It’s since dropped to 14th place. The price graphs of popular pairs look a lot more realistic now, with no too-pretty sine waves. This suggests that wash trading has been dialed back, but it still makes us a lot more hesitant to recommend OKX.

Coins Available

OKX currently has about 350 different cryptocurrencies available for purchase, ranging from well-known usual suspects like Bitcoin and Etherum to sub-dollar tokens for fans of particular football clubs. It’s not nearly as many as KuCoin, but about 100 more options than you’ll get on close competitor Crypto.com (see our Crypto.com review for details).

Assets are broken up into several categories, including Meme (DogeCoin, Shiba Inu, FLOKI), GameFi (The Sandbox, Decentraland) and Hong Kong-specific projects.

At the time of writing, these are the 10 most popular coins on OKX by market cap (the total value of available assets):

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- BNB (BNB)

- USD Coin (USDC)

- XRP (XRP)

- Cardano (ADA)

- Dogecoin (DOGE)

- Polygon (MATIC)

- OKB (OKB)

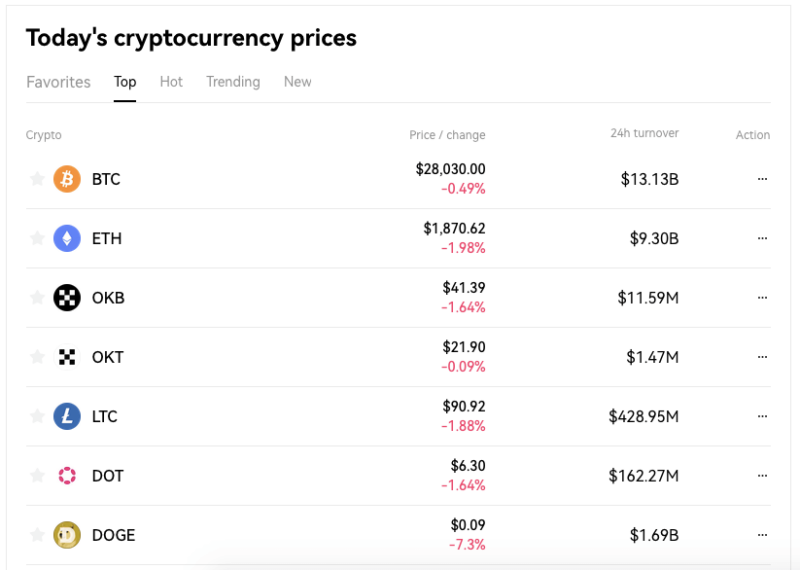

Oddly enough, the coins on the “top” tab are not the same as the highest-cap coins on the “all” tab. It’s not clear how OKX determines which coins it features on the “top” tab, but it’s suspicious that its own two tokens — OKB and OKTC — receive higher billing than normal.

OKX also offers a wide range of alternative products, including margin trading, futures trading, perpetual swap contracts and trade options.

Trading Fees & Rates

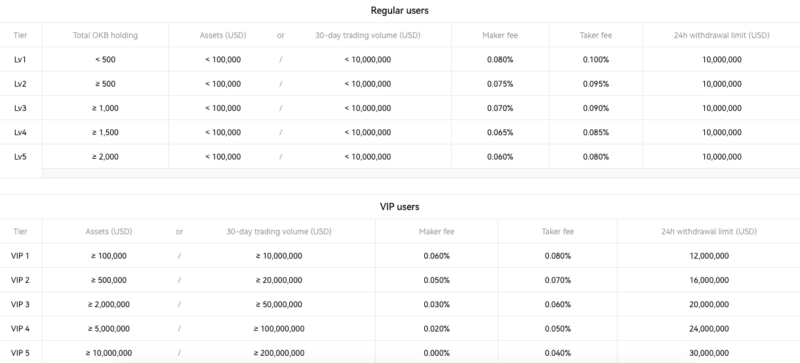

The OKX exchange fees include no monthly charges for a trading account. Like most crypto exchanges, it instead takes a small percentage of every trade on the platform. While OKX’s fees start out low, users can reduce them even further by climbing up the ranks of a somewhat convoluted tier system.

The fee structure incorporates maker and taker fees. Unfulfilled demand increases the liquidity of a market. When a user submits a bid that can’t be filled right away, they add liquidity and pay lower fees as a maker. If a user places an immediate order at the current market price, they’re a taker and must pay more to compensate for the liquidity they’re removing.

Regular & VIP Pricing

To start, OKX sorts users into two broad categories: regular and VIP. Any user who holds less than $100,000 worth of assets AND trades less than $10,000,000 in a 30-day period is considered regular. When you pass either of those milestones, you’re a VIP.

Regular users advance through the ranks by holding OKB, the coin pegged to OKX’s business performance (not to be confused with OKTC, the token for its technical infrastructure). The more OKB you hold, the higher your tier and the less you pay per transaction. Each tier drops the maker and taker fees by 0.005%.

Once you’re a VIP, your OKB holdings no longer matter. Instead, your tier is determined by your held assets OR your 30-day cryptocurrency trading volume in U.S. dollars. Each VIP tier drops maker and taker fees by 0.01% and increases your daily withdrawal limit by $4,000,000. By the time you get to VIP five, maker transactions are free; at VIP six, OKX starts paying you.

OKX maintains different percentages for trading futures and options, but they all use the same structure — only the maker and taker fee percentages change. One last important note is that there are no maker fees for any U.S. Dollar Coin (USDC) currency pairs.

OKX Withdrawal Fees

OKX takes an unorthodox approach to withdrawal fees. You have to pay to withdraw currency from your crypto wallet, but the costs aren’t fixed. Instead, the OKX platform calculates withdrawal fees on a case-by-case basis, “based on the complexity of completing the transaction.” More complex trades equal higher fees.

Once you’ve seen the projected fee, you have the option of changing it (as long as it remains above zero). If you set the fee higher, your transaction will process faster, while if you give yourself a discount, you’ll have to wait. It’s slightly better than what you’ll currently get from Binance (see our Binance review for details) but far from an ideal system.

User Experience

OKX is not available in the U.S. or Canada. Unlike KuCoin, which Americans can still use in a limited fashion, OKX is fully inaccessible in both countries (however, it’s not illegal, and you can still make trades with USD). Since we’re based in the U.S., we turned to ExpressVPN to help us explore the exchange using a U.K. IP address.

OKX lets you choose how deeply you want to engage with it. At the simplest level, you can buy crypto and withdraw it as fiat with a sleek, smooth interface. To buy more complex assets, you’ll have to wade through some deeper thickets, but none that should seriously trip up an intermediate trader.

Signing Up for an OKX Account

As long as you’re in a country where OKX is licensed to trade, you can sign up by providing an email address and password. Enter a verification code from your email, and you’re in — at verification level zero.

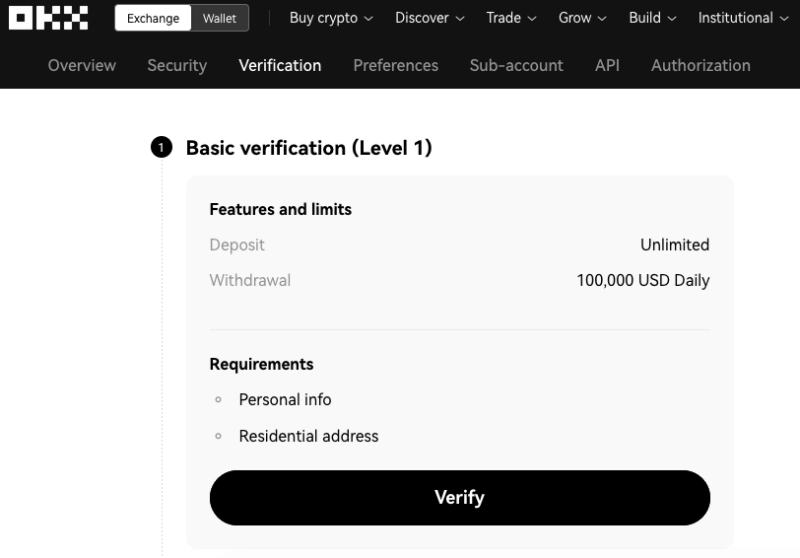

You’ll need to be at least level one before you can deposit or purchase any funds. The level one know-your-customer (KYC) protocols just require you to enter a residential address and ID number.

To reach level two, you’ll have to provide ID, a photograph, proof of address and the initial dollar value you plan to invest. It’s hard to give up so much information, but nobody ever said crypto was anonymous to begin with.

Crypto Trading on OKX

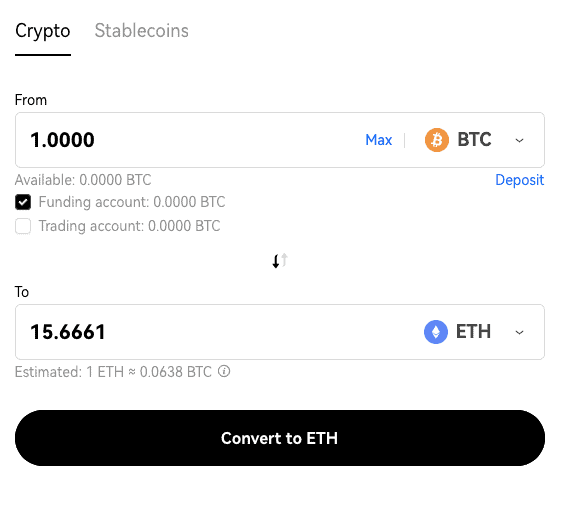

The absolute simplest way to trade crypto on OKX is by converting one currency into another for no charge. If you think one currency is likely to do better than another, you can instantaneously convert it to another coin at market rates. OKX supports conversions between all cryptocurrencies and stablecoins on the exchange.

If you own an asset that OKX doesn’t support, you can add it to your wallet, convert it to another asset, then trade with it as normal. Keep in mind that instantaneous conversion does not apply to fiat currency, though you can convert from crypto to stablecoins and vice versa.

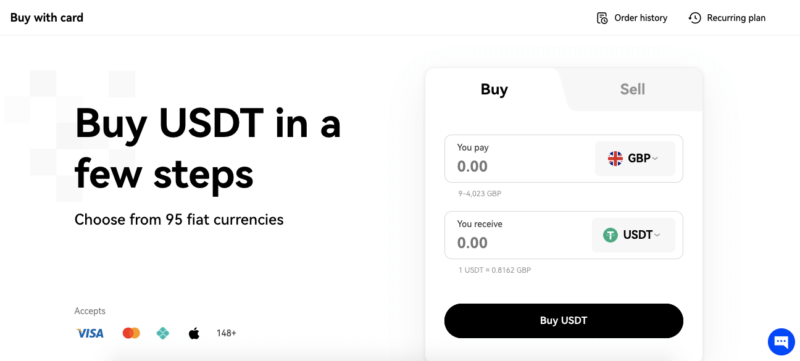

Next up the complexity ladder, users can buy crypto by spending fiat with a credit or debit card. Card purchase, which accepts 96 fiat currencies in exchange for about the same number of cryptocurrencies, is the fastest way to get your own liquidity onto OKX. Purchased assets go directly into your account and can be used to trade right away.

Unfortunately, there is no way to deposit fiat into OKX without immediately converting it into cryptocurrency, so you can’t hold your dollars in an account while waiting for the right time to strike. If that’s your style, your best options are to buy a stablecoin like Tether (USDT) or hold your money in a third-party crypto wallet (which we recommend you do anyway).

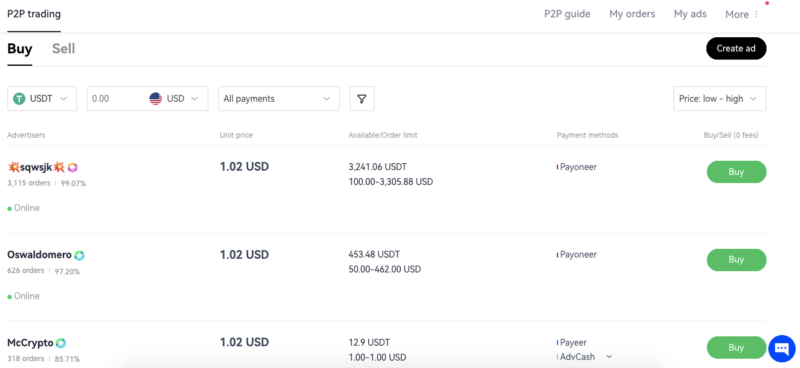

Peer-to-Peer Trading

OKX also supports peer-to-peer trading, in which users can buy and sell crypto directly in exchange for fiat, without going through the spot market. This lets you dodge trading fees, but you’re limited to the trades currently on offer — and OKX’s P2P trade volume is low. We had a hard time finding any orders outside the most popular assets.

Spot Trading

If you know what you’re doing, you can move on to the full spot trading interface. While it looks intimidating, it’s actually not hard to understand as long as you know a little about the basics of trades. We recommend it for intermediate users and above.

Spot trading for all products, including margin and futures contracts, looks largely the same.

The left-hand pane shows the real-time prices of popular cryptocurrencies; the right-hand pane is the order book. The graph shows the fluctuating value of the lead currency (BTC in the screenshot above), with gains in green and losses in red.

The only part of this that’s actually a user interface is the purchasing menu at the bottom. From here, you can set limit orders to buy a certain amount of currency at a specified price (paying the maker fee), or market orders to instantly purchase coins at market price (paying the taker fee). The right-hand menu is for selling.

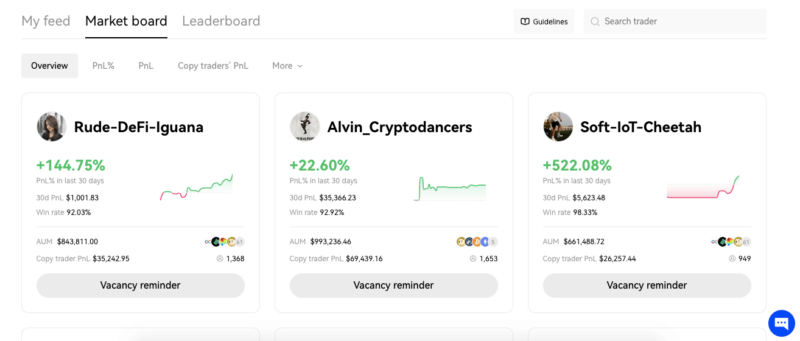

Copy Trading

One final feature worth mentioning is called “copy trading.” This feature lets users join communities led by experienced crypto traders, who are selected for their high rates of return. Members of a trader’s entourage can automatically execute the same trades they do, while the lead trader gets 10% of the profits.

It’s essentially a smaller-scale, crypto-friendly version of a managed fund, with the caveat that no investor can guarantee returns that beat the market. Copy trading is a nice way to demystify crypto exchanges, but in the end, you’re putting your investment funds into the hands of a stranger. Do so at your own risk.

Staking on OKX

If you’d prefer a slightly more reliable source of income, OKX offers several options for putting your cryptocurrency to work making money passively. You can put your tokens into high-yield savings accounts that OKX uses to loan out money, just like a normal bank. These claim an annual growth rate of 5-10%.

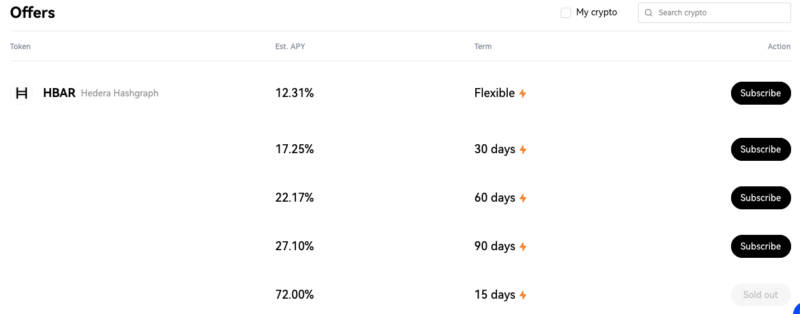

Staking offers higher yields with the same relatively low risk. You can contribute your assets to fund the upkeep of various blockchains; in return, you get the first rights to some coins mined out of those chains. Estimated returns range from 3% to as high as 72%, though as the OKX website warns, “Historical returns are not indicative of future returns.”

Shark Fin & Dual Investments

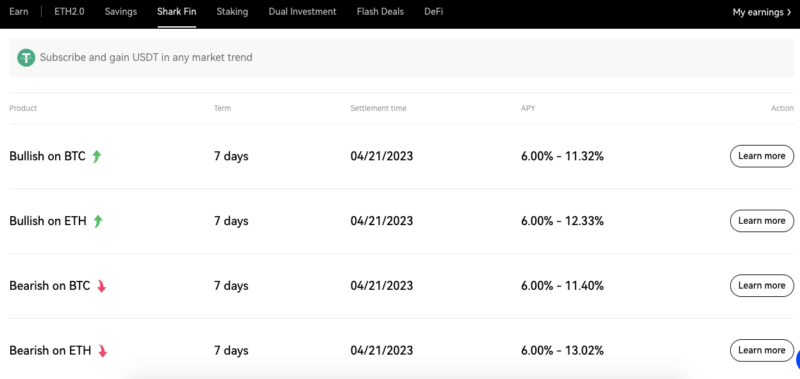

Next, there’s something called “Shark Fin,” a uniquely bizarre offering. Shark Fin lets users bet on the direction of a certain asset by specifying a direction and a range — for example, “in seven days, BTC will be between $18,000 and $21,000.” If you guess right, you make a percentage on your principal based on the size of your range. If you guess wrong, you make 1%.

Either way, you get all your principal back, so Shark Fin is basically free money. As for what OKX gets out of the deal, the exchange is presumably betting that most people will guess wrong, giving it cheap liquidity that they can lend out for much more than the 1% return you’ll make.

Although Shark Fin appears to have no downside, it may not be a good choice unless you’re absolutely certain you know where the market is going. While your money is locked up for a chance at a 10% return, you can make a guaranteed 10% or more through savings and staking.

“Dual investment” is a simplified futures contract. If you plan to acquire a coin for a certain price at a certain time, you can make a dual investment and guarantee that you’ll get extra USDT if you have to pay more than market rate. It’s a hedge to ensure you don’t lose principal even if you misjudge the market.

Finally, you’ve got the option to fund decentralized finance (DeFi) projects for decent returns — similar to staking, but going beyond blockchain infrastructure itself. OKX includes a separate tab that lists all the highest-yield opportunities currently available, playing to its main strength of connecting users with unexpected deals.

Customer Support

OKX comes with a set of gamified tutorials for new users, who can complete “learning missions” to earn small amounts of bitcoin. Those looking to hone their skills can engage in demo trading, which lets them practice the mechanics of crypto trading using fake money.

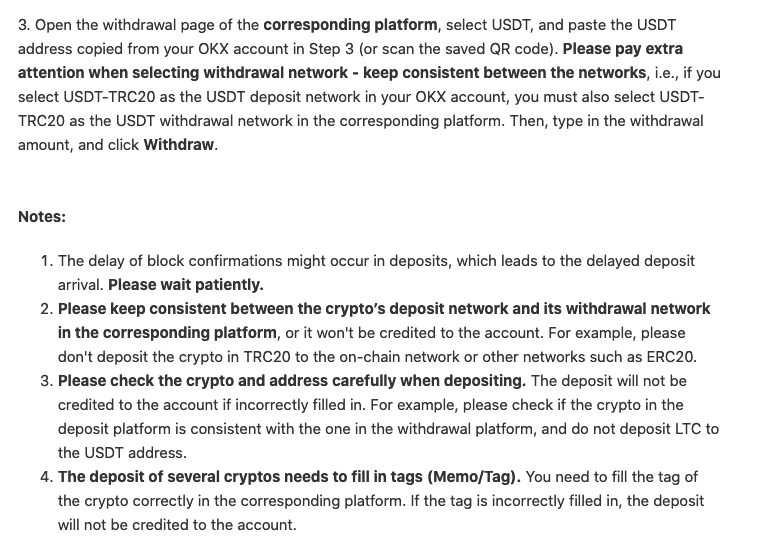

For everyday support, OKX comes with an extensive FAQ page. We tested it by coming in with a typical problem — how to deposit crypto from another wallet — and took some time to find the article. It wasn’t written very clearly, and understanding it required knowledge from other articles that weren’t linked.

You can start a live chat from anywhere in the help center, but it’s also not especially friendly — in fact, its main purpose seems to be delivering ads.

You can submit a ticket to get more complex problems solved, but your best chance for help might be on OKX’s Reddit and Discord communities. It’s the best way to ensure a real person hears your problem.

Final Thoughts: OKX Review

We can’t recommend OKX to anybody in the United States or Canada. You could use it with a VPN, but there’s no reason to do that when higher-volume exchanges are available. Americans and Canadians can use Okcoin, a U.S.-based exchange owned by OKX’s parent company.

For everyone else, our verdict on OKX comes down to whether it’s learned from the false volume incident and the fallout from its CEO’s arrest. Frankly, given the manipulative nature of features like Shark Fin, it doesn’t seem like OKX is putting trader satisfaction ahead of liquidity in 2023.

However, OKX provides competitive trading fees and good opportunities for high-yield staking, and its friendliness to beginners is a positive touch. It also supports a wide range of nearly 100 fiat currencies, so it’s useful for users who want to make their purchases with less popular currencies.

What’s your opinion on our OKX exchange review? Do you agree with our take, or does it not match your experience with this trading platform? Let us know in the comments, and thanks for reading another crypto review — we’ll see you next time.

FAQ

Yes, they’re the exact same exchange. OKEx rebranded as OKX in 2022 to declare it had become “more than an exchange” thanks to a wider range of products.

OKX appears to be one of the safer cryptocurrency exchanges, having never suffered a major breach. However, its users did once lose access to their funds for over a month while the CEO was under arrest.

No, OKX is not available in the United States or Canada. Users in those countries still have access to Okcoin, however, which is owned by the same parent company.