The Ultimate Guide on How to Buy Bitcoin in 2024

Bitcoin has drawn plenty of attention since its first sharp rise in 2017. However, it’s easy to avoid virtual currency just because it seems complex. So, even if you’ve only just heard about this “crypto” thing, this article will guide you through the first steps of how to buy bitcoin.

Although we’re not exactly investment gurus who can tell you precisely when and where to invest your money, investment advice for cryptocurrencies is useless if you don’t know how to purchase bitcoin in the first place. So read on and learn the easy steps for how to buy bitcoin.

Key Takeaways:

- It’s easy to buy and sell bitcoin if you have the right tools.

- Picking a good exchange and cryptocurrency wallet is vital to your privacy and the security of your investment.

- Most bitcoin transactions come with a small fee, so check these before buying anything.

- You can purchase bitcoin with any payment method you want, as long as you find an exchange that supports it.

Like any investment, bitcoin carries a lot of risk, but unlike traditional savings accounts that go up at a slow and steady pace, bitcoin prices can vary wildly within a short span of time. However, you can trade in small fractions of bitcoin, so there isn’t too much at risk while you’re learning the ropes.

Once you’ve decided how much you want to buy, you can start looking for an exchange and a crypto wallet. These are important, so be sure to look at many options before you start creating accounts and begin buying bitcoin. This isn’t something that you need to rush, but after you’ve got the right exchange and wallet, you can start trading.

-

06/10/2021

Cloudwards.net updated this article to add information on the most common payment methods for buying bitcoin and added images to the full step-by-step guide.

Before You Learn How to Buy Bitcoin

Bitcoin — as with all cryptocurrencies — can be difficult to understand. Luckily, you don’t need to know the details about where it came from, how “mining” works, or what the “bitcoin blockchain” is in order to trade with it.

One thing you should learn before you start trading is what bitcoin is. Unlike traditional government-issued fiat currencies, cryptocurrencies aren’t controlled by a government or organization, but are traded directly in decentralized exchanges. The lack of any middlemen is great for privacy, as there’s no bank scanning each of your transactions. However, that also makes it harder to control, leading to its volatility and security issues.

So, if you’re big on privacy and want to hide as much of your life as possible, buying bitcoin for your digital purchases might be worthwhile. Of course, not everyone takes bitcoin, but it’s becoming more common. Most of the top VPNs and organizations — even Wikipedia and Microsoft — now accept it.

You should also understand that bitcoin isn’t the only cryptocurrency available. Most bitcoin exchanges will let you trade in cryptocurrencies like ethereum, bitcoin cash, litecoin, dogecoin, ripple XRP, NEO, IOTA and more. As long as your cryptocurrency wallet can hold it, you can trade it.

Choosing a Bitcoin Exchange

Before you buy any bitcoin, you also need to find an exchange. There are many cryptocurrency exchanges you can use, but some charge higher transaction fees, others have limits on how you withdraw funds and a few may even be scam sites rather than legitimate exchanges.

When choosing an exchange, go for one with lots of users, low fees, good customer service and a solid insurance policy. Platforms like Binance, Bitstamp and Coinbase are all great choices for beginners, but there’s no need to stick with one exchange forever if you find another one you prefer.

Choosing a Bitcoin Wallet

Moving your bitcoin from your exchange account to a separate cryptocurrency wallet is a smart way to protect it from hackers, so it’s important to make a good choice here as well. You can choose either a “cold” wallet or a “hot” wallet (more on this later), but you need to make sure it’s secure to keep your digital assets safe.

Much like with choosing an exchange, you should try to find a popular wallet with good customer service, plenty of security advice and no knowledge of your private key — which works in the same way as zero-knowledge cloud storage.

Some good digital cryptocurrency wallets include Exodus, Electrum and Mycelium. Plus, companies like Trezor and Ledger make physical wallets that are trusted by many users. You can also use an exchange wallet — the wallets provided by companies like Binance — although some people question how secure this is, as the exchange has control of your private keys.

Step-by-Step Guide to Buying Bitcoin

To purchase bitcoin, you’ll need to have your bitcoin exchange and a bitcoin wallet ready. However, you can also choose to use a cryptocurrency exchange, like Binance or Coinbase, which will do both with just one account. You’ll need a VPN for Binance if you’re in a country or region where it’s banned.

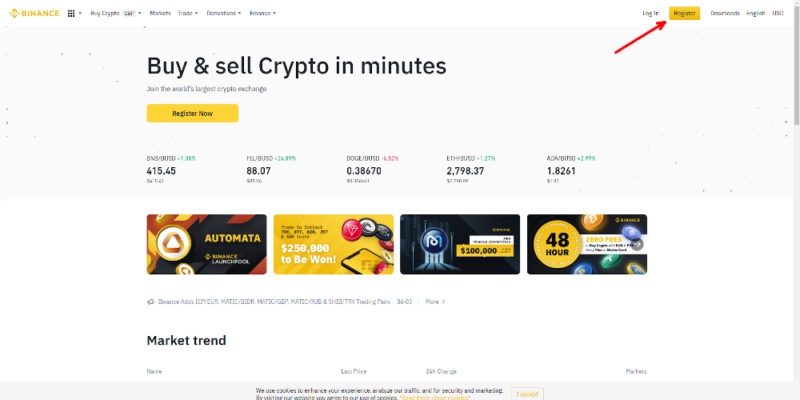

- Choose Your Exchange and Create an Account

Pick an exchange that will accept your payment method and create an account. For this example, we will use Binance.

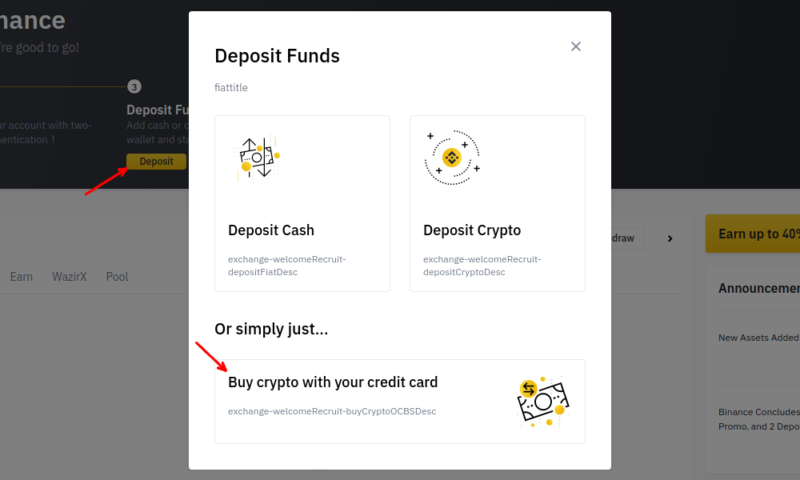

- Choose to Buy Crypto

Once your account is verified, you’ll see “deposit” options, which will let you add funds to your account. Or, you can choose “buy crypto with your credit card.”

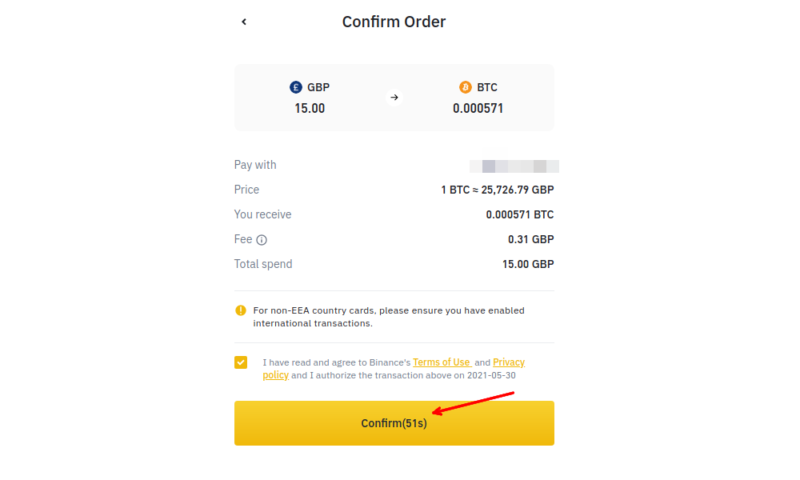

- Finish the Purchase

Choose how much bitcoin (or fractions of bitcoin) you want, enter your payment details, note the transaction fee that the exchange will charge and click “confirm.”

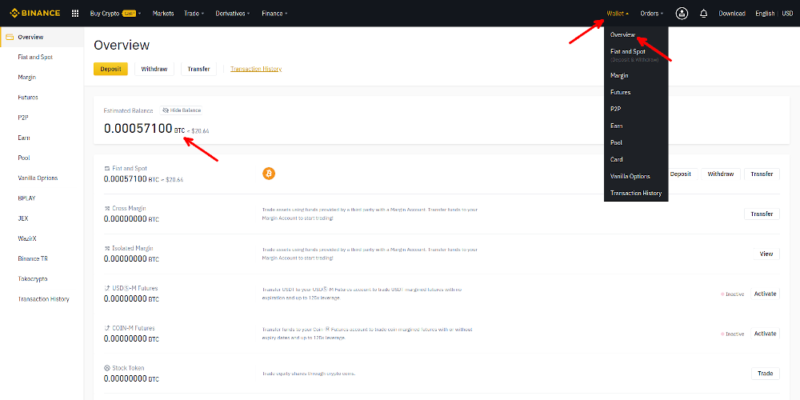

- Go to Your Wallet

When you go to your wallet overview, you should now be able to see the value of your bitcoin and the options to withdraw or transfer it.

How to Move Your Bitcoin to Your Wallet

After making your bitcoin purchase, you’ll probably want to move it into your wallet. The specific provider you choose doesn’t matter too much, as long as it can support bitcoin and is trustworthy, so for these steps we’ll use Exodus.

- Download the Digital Wallet

Go to the provider’s webpage and click “download.”

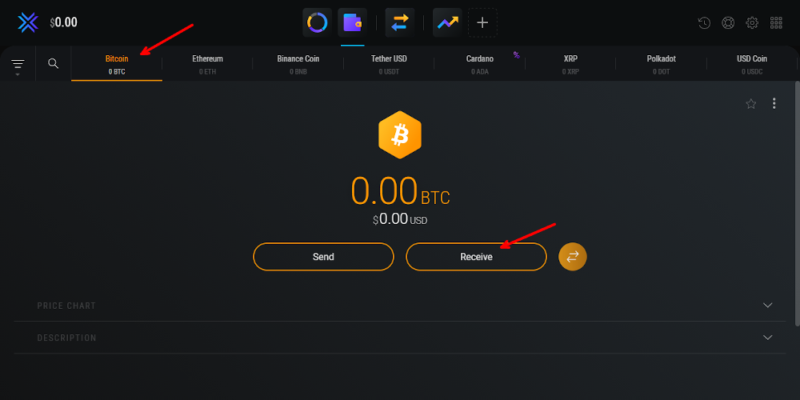

- Choose to Receive Bitcoin

In the “wallet” tab, select “bitcoin” and click on “receive.”

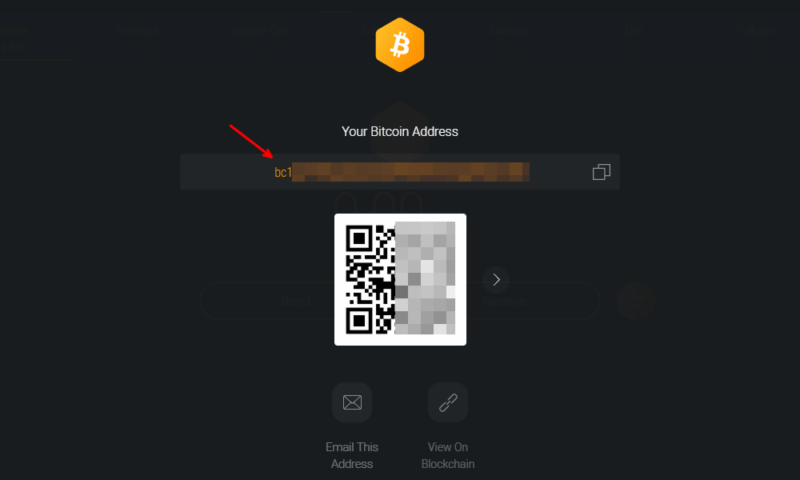

- Get Your Computer’s Bitcoin Address

Your bitcoin address should now be on the screen; copy it to the clipboard or write it down.

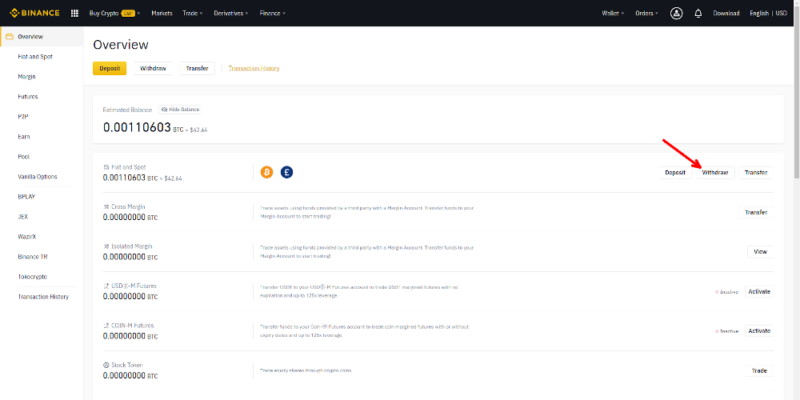

- Withdraw Some Bitcoin

Go to the exchange where you brought your bitcoin and click “withdraw.”

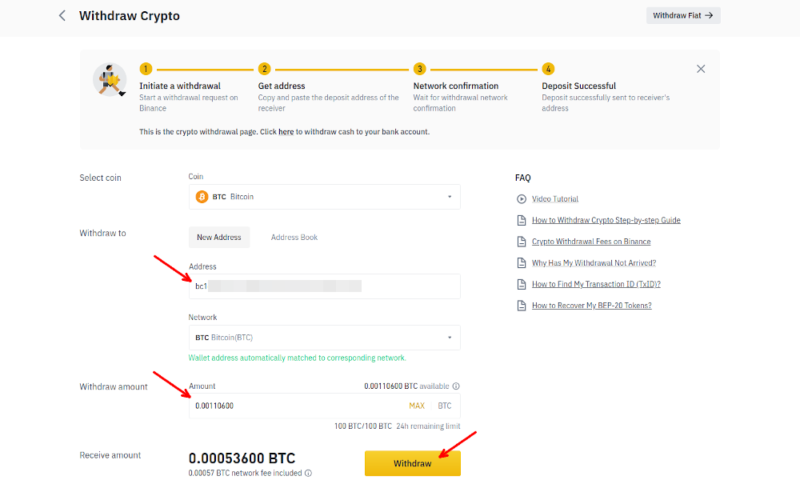

- Enter Your Details

Paste your wallet’s address, enter the amount you want to move and click “withdraw.” Note that the network will take a small fee for the transfer and that there will be a minimum transfer amount.

Bitcoin Payment Methods

When you’re buying bitcoin, you can often choose how you want to pay for it. These options vary depending on the exchange, but most people will use one of these four options, usually based on how much privacy they’re willing to give up for ease of use.

Credit Card or Debit Card

Buying bitcoin with credit or debit cards is the simplest method; most exchanges accept them — all you need is a bank account and it lets you purchase bitcoin instantly. However, there are a few drawbacks to using this method.

The biggest problem is that, while practically all exchanges accept cards, some banks will stop any credit card purchases involving less popular exchanges. Even if they don’t stop the payment outright, they might consider it a cash advance and charge you an extra fee.

Another problem with purchasing bitcoin with a card is that your bank will monitor your account. If you don’t intend to trade bitcoin, but instead want to get away from the prying eyes of big businesses and governments, this is a serious issue.

PayPal Account

Although you can purchase bitcoin through your PayPal account — alongside ethereum, litecoin and bitcoin cash — it can also be used to put fiat money into your exchange account. This can help you hide some personal data from the crypto exchanges, and gives you PayPal’s extra buyer protection, which can be a step up from what your debit card provides.

However, not all exchanges accept PayPal, so you should confirm that yours does before you make an account. You also have to consider that PayPal can freeze your account after any suspicious purchases, and they might charge you higher fees than if you just used a credit card.

Remember, too, that while PayPal has better buyer protection than some debit cards, most credit cards have a comprehensive charge-back system in case something goes wrong. Between this and Section 170 of the Fair Credit Billing Act, your money may be more secure going through a traditional bank.

Security isn’t the only problem, though. Despite PayPal shielding some of your bank account details from the exchange and vice versa, it has access to all of that information itself. Ultimately, if you want to keep your personal data safe from everyone, you can’t have a third-party provider handling your cash.

Bitcoin ATMs

Bitcoin ATMs are exactly what they sound like, and they’re the solution to the privacy concerns with bank accounts and PayPal. You can use a bitcoin ATM in the same way you would use a regular ATM, except it’s connected to your bitcoin wallet instead of your bank account.

This avoids the normal privacy issues because cash is much harder to trace — although not impossible — and only you know the exact details of each part of the transfer. Nothing’s stopping you from taking money out of your bank account and moving it around to obscure the transaction before depositing it.

However, bitcoin ATMs suffer a problem that digital transactions never will — you need to have access to them. If you can’t find any in your immediate area, trading bitcoin may require a long drive. This problem can get even worse if the ones near you aren’t two-way ATMs and can only be used to purchase bitcoin, as you’ll have to travel even farther to sell anything.

You’ll also need to have the address to your cryptocurrency wallet ready for when you make each transaction. This is true for any purchase, but when you do it online you can copy the address over, rather than writing it down and typing it manually.

P2P Exchanges

Although bitcoin ATMs are far more private than most other options, if you’re looking for total control over your data and the transfer, you should use a peer-to-peer (P2P) exchange. These platforms help you find someone who has bitcoin to sell. After that, the rest of the purchase process is determined by the buyer and seller — with no middleman.

Obviously this kind of exchange has a lot of risk. The seller could take the money and run, the buyer may not pay in full or a criminal could swoop in and meddle. You can avoid this by using an escrow account or paying through bank transfers with buyer protection, but both are traceable and give some companies more information than necessary.

However, if you’ve found a reputable trader, a P2P exchange offers some advantages over a more centralized exchange. The fees are often the lowest and they support virtually every payment method. If you’re near the seller, you could even physically hand them the cash for the bitcoin.

So if you want to own bitcoin but don’t want anyone to know about it, P2P is probably your best option. Just make sure you find a seller with good reviews and a decent selling price, and maybe don’t buy $10,000 worth without testing them with a smaller amount first.

Cold Wallets vs Hot Wallets

When you go to find a personal wallet to store your bitcoin, you’ll probably come across the terms “cold wallet” and “hot wallet.” Both kinds of wallets can be useful, but it can be confusing to know which to use and what the differences are.

Luckily, there is one clear distinction between the two types. Hot wallets are always connected to the internet, while cold wallets are not.

More specifically, hot wallets are normally apps or web pages that access your information over the internet to allow you to deposit or withdraw bitcoin. Since you’re already connected, using these online wallets takes little more than a few clicks.

On the other hand, cold wallets are physical devices that plug into your computer when you want to use them. Not all cold wallets are digital; for example, a paper wallet is just a slip of paper with a single-use address and private key that holds an amount of bitcoin. However, when most people talk about a cold wallet, they’re specifically referring to digital wallets.

Normally, you would use a hot wallet for short-term trading. This is because it can support a wider array of cryptocurrencies and allow you to buy and sell bitcoin much more quickly. However, using a cold wallet is far better for longer term storage, as it’s less susceptible to cybercrime because the private key is kept on the device itself.

A cold wallet also comes with a much higher price tag — often over $100 for a basic device. This can be off-putting for new bitcoin buyers, who would rather use a free hot wallet. Although this is reasonable for small amounts, if you’re storing more than a few hundred dollars in bitcoin, a cold wallet is your best defense against losing it all.

Final Thoughts

Now that you’ve got a cryptocurrency exchange account to make your bitcoin purchases and a wallet to keep your digital currency safe, you’re all set up to start trading bitcoin. Just don’t go overboard, as bitcoin can — and regularly does — crash. Read our crypto exchange crash article to learn more about the future of decentralized finance.

You should also remember that in order to start selling bitcoin, you’ll need to follow these steps in reverse. First transfer the bitcoin from your wallet to an exchange, then convert that bitcoin to your local currency so you can transfer it into your bank account.

Finally, while trading bitcoin, you should make sure that you keep your personal information safe. This means getting a good antivirus to ensure your device isn’t plagued with keyloggers, a reliable VPN for crypto trading to make it harder for potential attackers to do things like track your IP, and a solid backup for your bitcoin wallet.

Are you interested in buying and selling bitcoin? Did you use these methods? What exchange and wallet did you choose? Let us know your thoughts in the comments section below. Thanks for reading.

FAQ

Buying bitcoin is best done through an exchange, where you simply enter your debit card details, choose how much bitcoin you want to get and click “buy.”

Beginner-friendly exchanges like Coinbase and Binance will help you make your first purchase. Just create an account and follow the steps — they even provide a wallet for you to use.

The specific price of one bitcoin changes all the time, between a few thousand dollars to tens of thousands of dollars. The best way to get an up-to-date price is on an exchange, but even then the price is constantly moving.

Most exchanges set a minimum order, which is usually pretty low — such as Coinbase’s minimum of $2 — so you should be fine with $20. However, if you’re unsure, you can find this on the exchange’s customer support page.