Gemini Review

Gemini bills itself as a secure, user-friendly crypto exchange for U.S. users, but some of its products haven’t paid off for investors in the past. Our Gemini review rates this popular exchange on its available coins, trading fees, user experience and more.

Key Takeaways: Gemini Crypto Exchange Review

- Gemini’s reputation is built on security. In eight years of operation, it’s never had assets stolen by hackers, though at least one of its partners has.

- Trading fees on Gemini are expensive, especially on its web and mobile apps. Crypto conversions also cost money. Fees are lower on the Gemini ActiveTrader platform, but still relatively high.

- Gemini no longer offers a loan program because of SEC intervention, and staking opportunities are limited. However, it does let you trade perpetual contracts, and futures are in the roadmap.

Every crypto exchange needs a niche to stand out from the increasingly crowded field. Gemini wants its niche to be security. It bills itself as the crypto exchange that won’t collapse or screw you over, a salient message in the wake of the FTX scandal. In our Gemini review, we’ll examine whether Gemini makes good on its reputation for integrity.

We’ll also cover everything else you need to know about the Gemini exchange: what assets it offers, whether its trading fees are reasonable, other features on the platform and whether it’s pleasant to use.

Before we start, our usual disclaimer. Cryptocurrency is a volatile asset class by nature, and steep price plunges are just as likely as rapid rises. When you trade crypto, always have an exit strategy, and never invest more than you can afford to lose.

Gemini Review 2025: Pros & Cons

Pros:

- Add fiat currency to account

- Trade perpetual contracts

- API is useful for trading bots

- Extremely security-focused

- Well-designed interface

Cons:

- Requires full verification

- No crypto lending options

- Limited trading pairs

- Suffered many breaches

- Hit with regulatory actions

Overview & Background

Gemini was founded in 2013 by Cameron and Tyler Winklevoss, the twin investors made famous in the movie The Social Network. It posted its first bitcoin trades in 2015 (learn what Bitcoin is), arguing that its private-key system could protect cryptocurrency better than any other exchange’s.

For the next seven years, Gemini operated without serious incident, expanding its offerings and winning approval from U.S. regulators more readily than many of its rivals. Though it experienced service outages, including during the rapid 2017 price expansion of bitcoin, none of its customers ever had their funds stolen by fault of Gemini.

A pair of incidents in 2022 shook Gemini’s reputation. In June, the Commodity Futures Trading Commission (CFTC) sued Gemini, alleging that the exchange manipulated the price of bitcoin to inflate the value of its futures contracts. The current status of that lawsuit is unclear.

In December, Gemini suffered its first major security breach, as hackers used phishing emails to steal login data from nearly 6 million users. The hackers didn’t steal any money, and Gemini’s security appears to have frightened everyone off from exploiting the data — the thieves could not find a buyer for their stolen credentials.

2022 IRA Lawsuit

Gemini sometimes partners with other crypto companies to provide services the partners can’t handle in-house. One of these partners, IRA Financial Trust, offered retirement accounts based on “alternative assets” like cryptocurrency. IRA relied on Gemini to keep its assets secure.

In early 2022, thieves stole $36 million in cryptocurrency from IRA Financial Trust’s accounts. In the wake of the theft, the partner filed a lawsuit against Gemini for failing to adequately secure its systems, claiming that Gemini pressured IRA Financial Trust to purchase expensive, flawed onboarding APIs. The case is ongoing at the time of writing.

Gemini told the press that it didn’t consider the event a breach of its own security, maintaining that because IRA Financial Trust was hacked and not Gemini, the flaw must have come from their implementation. Without a court verdict, it’s up to you whether to consider this breach a dealbreaker.

2023 SEC Action

While Gemini suffered through the recent crypto winter with everyone else, it took another hit from American regulators. The Securities and Exchange Commission (SEC) alleged that the exchange failed to register Gemini Earn, a feature through which users could lend out their held cryptocurrency and make interest money.

The failure to register Gemini Earn was more than just a legal problem. In November 2022, investors found themselves unable to withdraw assets from Gemini Earn because the program was too short on liquid cash. Since SEC registration is explicitly designed to prevent that sort of thing, the commission was understandably upset.

The SEC suit and cash-flow problems forced Gemini Earn to shut down in January 2023, but the lawsuit is ongoing, with the SEC seeking fines and damages for the customers whose assets were frozen. The action came as part of a larger trend of targeting passive income features on crypto exchanges — you can see another example in our Kraken review.

It wasn’t a full prosecution, as Gemini is still fully licensed and legal in the United States (though our article on where is crypto illegal shows where it isn’t). However, it’s a definite blow.

Coins Available

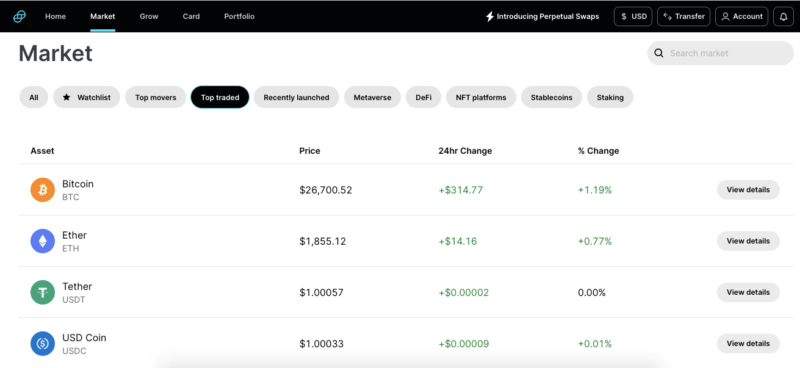

Gemini currently supports a total of 102 crypto assets, with 12 native assets (including BTC, ETH and LTC), six stablecoins (including USDC and USDT) and 84 tokens. At publication time, the 10 most popular by market volume are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Ripple (XRP)

- Cardano (ADA)

- Litecoin (LTC)

- Shiba Inu (SHIB)

- Uniswap (UNI)

- Stellar (XLM)

- Filecoin (FIL)

Although 100 coins is a decent number of tradable assets, it pales in comparison to many of Gemini’s close rivals. KuCoin, for example, lets users trade over 700 assets (see our KuCoin review for more details). Perhaps a bigger problem is that Gemini supports only 23 crypto-to-crypto trading pairs, though its crypto-to-fiat selection is larger.

Quality over quantity isn’t necessarily a bad thing, especially if you’re new to crypto trading. Gemini supports all the most popular currencies and trading pairs. However, if you’re a veteran trader hoping to get in on the ground floor of the next hot investment, Gemini might not be the place to look.

For those interested in trading crypto derivatives, Gemini offers margin trading and perpetual contracts, though futures and options aren’t supported yet.

Gemini Dollar

Gemini has its own stablecoin, Gemini Dollar (GUSD). As with all stablecoins, Gemini Dollar is intended to always have the same value of another currency — in this case, the U.S. dollar (USD). Gemini guarantees this by always holding USD equal to the amount of GUSD reserves, and reporting on the state of those USD assets every month.

Gemini Dollar is an appealing stablecoin for those who don’t trust Tether’s less-transparent approach. It’s comparable to USDCoin, which is also backed by fiat holdings. Though USDCoin has a larger market cap and wider availability, GUSD is more transparent about its reserves. Sadly, using GUSD on Gemini doesn’t come with any special treatment.

Trading Fees & Rates

Gemini has one of the more complicated fee schedules in the crypto world, with different fees depending on what interface you use to trade.

For orders placed using the web app, which will be most users’ first stop, Gemini charges a flat, bracket-based fee for orders under $200: $0.99 for orders under $10, $1.49 for $10 to $25, $1.99 for $25 to $50, and $2.99 for $50 to $200. Orders over $200 cost 1.49% of their total amount. You’ll also incur a “convenience fee” equal to 0.5% of the trading pair’s market value.

Traders who work through the mobile app incur the same fees. Note that the flat rates and brackets are different depending on the fiat currency used, though the 1.49% fee on larger orders remains the same. Gemini also charges 1.49% on all crypto conversions through the mobile or web app, except when wrapping FIL or unwrapping EFIL.

A total fee of 1.99% on most transactions, including conversions (which the best crypto exchanges offer for free), is comparatively enormous. The practice of charging higher fees to lower-tier users is common, but hard to justify — particularly when the lowest bracket on Coinbase only costs 0.6%. See our Coinbase review for more info.

ActiveTrader Fees

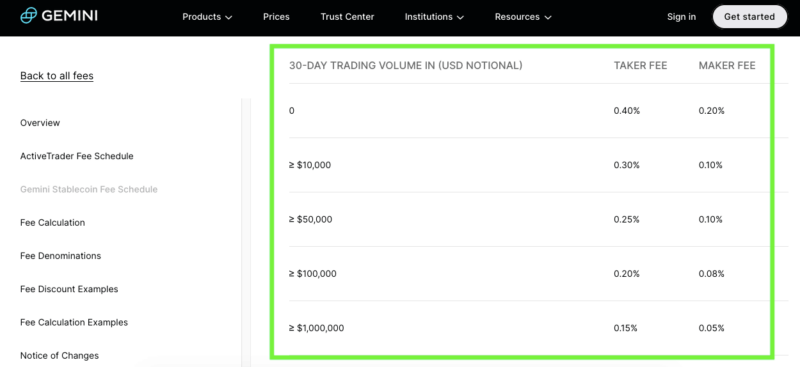

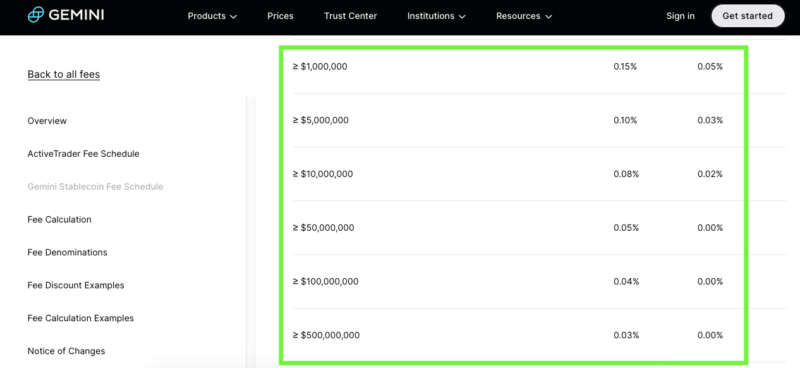

Advanced traders who use the professional-oriented ActiveTrader interface, or make any trades through the Gemini API, enjoy much lower fees on a more familiar maker-taker schedule. Taker fees apply to orders that fill immediately, while the discounted maker fees apply to limit orders that add liquidity to the order book.

The lowest bracket, applying to all orders less than $10,000, charges 0.4% for takers and 0.2% for makers. This is a lot better than the starting web and mobile fees but still not great by comparison. For example, Crypto.com (see our Crypto.com review) charges 0.075% for the lowest-level takers, less than a quarter of Gemini’s fee.

Gemini charges nothing to deposit crypto from another wallet, but charges a variable withdrawal fee to remove any crypto. Depositing fiat currency is free if you transfer straight from a bank account. Using PayPal costs you 2.5% of your deposit, and using a debit card costs 3.49%. You can also use ACH to withdraw fiat currency free, but a wire transfer costs a flat $25.

User Experience

There are four main ways to use the Gemini trading platform. You can go through the web app or the mobile app, use the advanced ActiveTrader interface, or trade through a bot or other third-party app using the Gemini API.

Newbie crypto investors should start with the web or mobile apps, since they are a lot friendlier and don’t presume much knowledge about how trading works. However, since the transaction fees are a lot higher, it’s in your best interest to graduate to Gemini’s ActiveTrader platform as quickly as possible. We’ll describe both further in the “crypto trading on Gemini” section below.

If you’re savvy with both crypto and software, you can customize your experience freely with the Gemini API. Currently, the API lets you integrate Gemini with third-party apps, such as interfaces to view current trades and bots to place orders automatically.

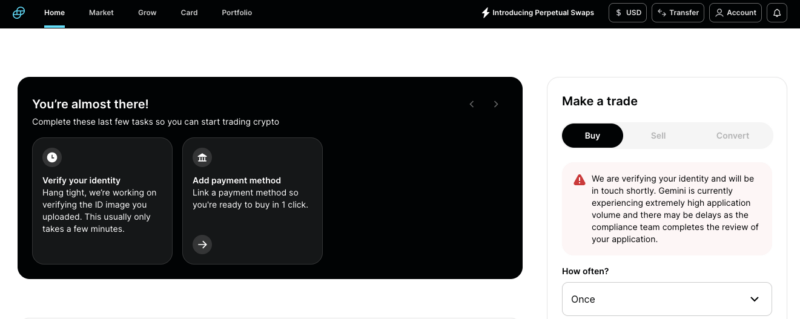

Signing Up for a Gemini Account

Signing up to trade crypto on Gemini is a more involved experience than with many crypto exchanges, since you can’t do anything without completing the full verification process. This means providing your home address, social security number, photo ID and a few other details. Our verification took approximately 24 hours.

You are also required to use the Authy app for two-factor authentication. There’s no way to opt out of this, and it must be done every time. If you lose your Authy password or delete the app, you can be locked out of your Gemini account for 24 hours while Authy resets.

Furthermore, Gemini automatically logs you out every time you close its window — which is annoying when parts of the website get you stuck, such as the Gemini Credit application. It’s definitely secure, but at the cost of a lot of inconvenience. (P.S. Even with a trading platform based on privacy, never assume crypto is anonymous).

Crypto Trading on Gemini

Gemini has one of the more appealing interfaces for trading popular currency. In exchange for the limited availability of digital assets, you get several simple ways to buy bitcoin and other high-value cryptocurrencies.

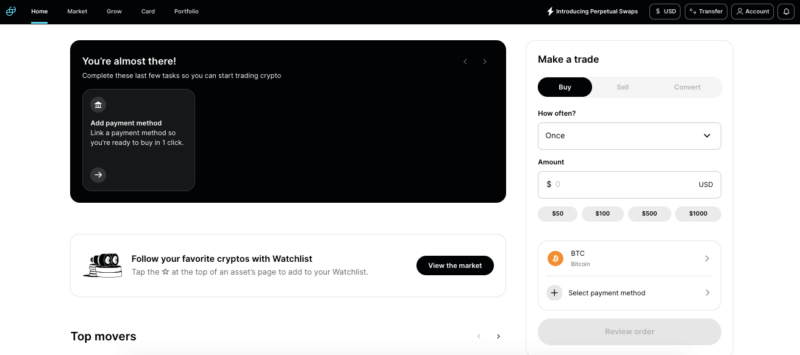

When you first complete your verification and gain approval to trade, you’ll arrive at the basic trading dashboard. Using the panel on the right of the screen, you can make your first one-time crypto purchase or set up a recurring order. Enter the amount of your default fiat currency you want to spend, choose a crypto asset and payment method, then review the order.

Once you have some crypto in your wallet, you can use the same interface to sell it or convert it to another currency. Don’t forget, though, that using the simpler web or mobile app will significantly increase your fees.

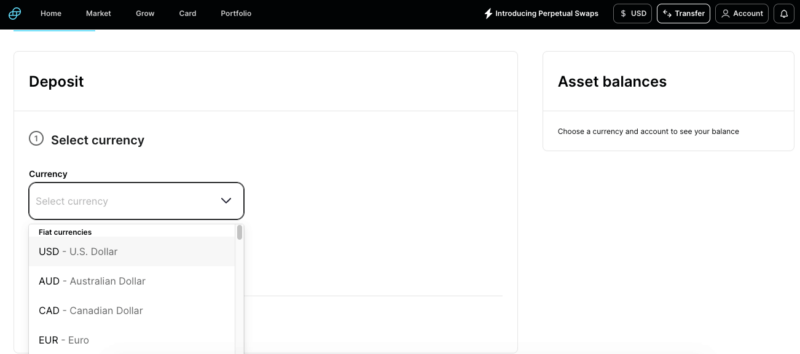

One of the nicest things about trading on Gemini is that you can deposit fiat currency to fund your account, then hold it there until you wish to purchase crypto. This lets you take your time and make more considered decisions with your hard cash. To do this, just click the “transfer” button at the top right. You can also transfer cryptocurrency between wallets from this page.

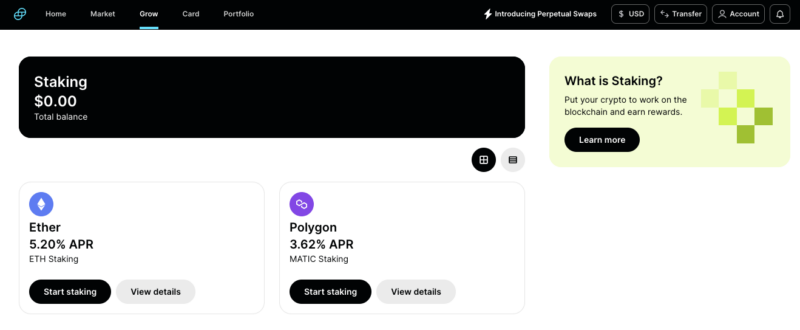

You can access staking through the “grow” tab. On the “card” tab, you can apply for a Gemini credit card, which works like a typical rewards card except that rewards come in the form of cryptocurrency on the exchange. It’s an interesting perk, but only for those willing to trust a more volatile form of rewards. That about wraps up what you can do on the basic interface.

Using ActiveTrader

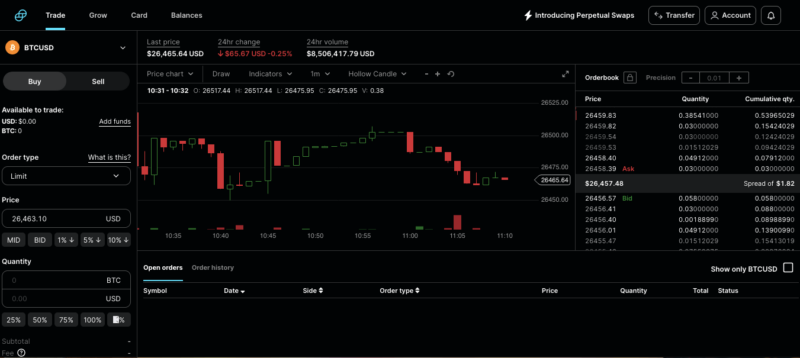

When you’re ready for more tools, more derivatives and lower fees, hop over to ActiveTrader. Just click on “account” at the top right and switch your interface on the menu that appears.

ActiveTrader looks like most other spot trading interfaces at first glance, but in keeping with Gemini’s wider target audience, it’s less busy than some other leading crypto exchanges. Buying and selling happens at the left-hand panel, and you can convert by selecting a trading pair with two cryptocurrencies. The dropdown menu lets you place different types of orders.

In the middle, you can toggle the shape of the price chart between line and candle graphs, add various indicators, change the timespan or superimpose a depth chart. On the right, the order book is constantly flashing with a needless visual effect, ActiveTrader’s one unforced error.

Staking on Gemini

Since the SEC shut down Gemini Earn, staking is the main way you can earn passive income on Gemini. You can stake any Ether (ETH) or Polygon (MATIC) crypto you own. If you don’t hold any yet, you can buy some and immediately transfer it for staking. This doesn’t accrue any fees.

Rewards for staking tend to hover around 4% per year, with the highest profit currently being 4.69% (for staking ETH). Despite Gemini having one of the better staking interfaces we’ve seen, we still advise caution — the SEC has targeted several staking features for the same reasons it’s been going after crypto lending products.

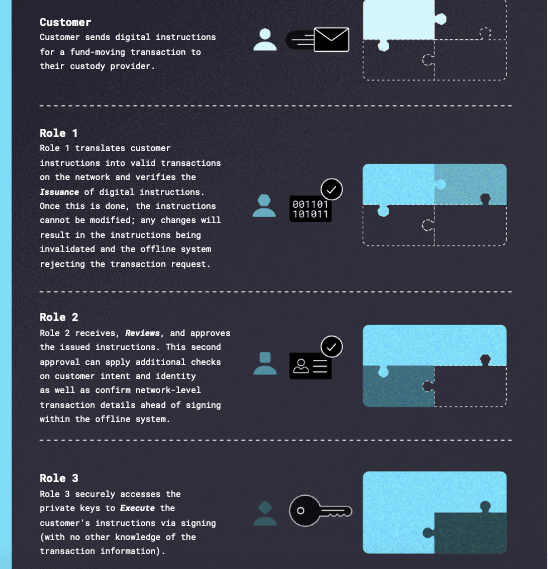

Gemini Custody

Gemini Custody is a high-security offline vault for storing your crypto funds. In essence, it’s a cold crypto wallet that stores assets without ever leaving your private keys in a place accessible via the internet. It meets the compliance standard for large crypto traders who are required to safeguard client assets.

Users can trade assets directly from their Gemini Custody accounts. While this is convenient, it also raises the question of exactly how cold the wallet really is. Fortunately, Gemini seems to have thought of this objection and published a guide on how this can be done securely.

Any user can create a Gemini Custody account, and there are no setup fees or minimum required balances. It does, however, cost $125 to withdraw assets from Custody and 0.4% per month per asset (minimum $30) to keep funds safe.

As these fees suggest, Custody is geared more toward large funds than individual retail investors. If you’re looking for alternatives that might fit you better, our best crypto wallet rundown has some ideas.

Customer Support

Gemini support starts with a help center with articles organized into eight topics, from making an account and trading to using the API. Gemini FAQs include some educational resources in basic crypto concepts, including links to a full Cryptopedia that begins with the basics of blockchain (though our what is blockchain article offers a more concise overview).

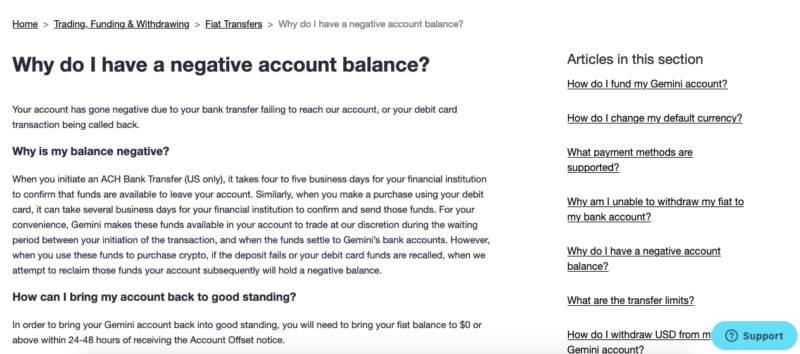

The articles about Gemini itself appear to have been written with the customer in mind and will be intuitive for those who actually trade on the exchange. For example, the page screenshotted below should provide some peace of mind to anyone freaked out by a negative account balance.

If the answers you need aren’t at the support center, you can start a chat by clicking the blue “support” button in the bottom right. This connects you with a bot that can search the help desk and link articles. If it can’t help you, it’ll give you the option to submit an email support ticket.

Final Thoughts: Gemini

Gemini occupies a clear niche in the crypto exchange industry. With its smooth interfaces, insistent security procedures and reinforced wallets, it could be the platform you choose if the other crypto exchanges make you suspicious. In a post-FTX industry, that’s a very lucrative position to hold.

It has its downsides, though, chiefly a limited selection of currencies. Those who want to expand their crypto horizons beyond Bitcoin and Ether might find the pickings slim. There are also a few hacking incidents and regulatory crackdowns that might set off user alarm bells. Finally, in our opinion, Gemini’s trading fees are too high for the brokerage services it provides.

With all that said, Gemini has never had crypto stolen from its wallets — so if security is your foremost consideration in an exchange, it may be the cryptocurrency exchange for you.

Do you agree or disagree with our Gemini exchange review? What other cryptocurrency exchanges do you prefer? Let us know in the comments. Thanks for reading.

FAQ: Gemini Exchange Review

Gemini suffered a hack in 2022 that compromised the credentials of 5.7 million users, though no actual currency was stolen. Thanks to its insistence on security measures and its protected wallet features, Gemini is one of the safer crypto exchanges.

Gemini Earn formerly allowed users to lend out their cryptocurrency in exchange for interest payments, providing a way to earn passive income. However, as of January 2023, it no longer exists.

Gemini is licensed to trade in the U.S. and offers its full suite of products for American users.

Yes, Gemini users can trade Dogecoin (DOGE).